Unveiling the Value of Time and Money: Pondering Life’s Priorities through Books and Reflection

Finding Serenity in Reading During Holidays

While I’m not an avid reader in my day-to-day life, I find solace in reading during my holidays. It’s a time when I can unwind and indulge in the joy of relaxation or knowledge acquisition, unburdened by my usual array of activities such as working on my PC, riding my motorcycle, experimenting in the kitchen, or engaging in my engineering pursuits.

Exploring the Significance of Time and Money through “Rich Dad, Poor Dad” by Robert Kiyosaki

During my recent holiday reading, I came across an intriguing concept that I’d like to focus on in this blog post. One key aspect that resonated with me is the power of exponential growth, and I wholeheartedly agree with its importance. When someone is young, time becomes one of the most valuable cards they hold. Without even taking significant actions, a young person with ample time ahead can rapidly grow their wealth simply by starting early.

The Explosive Power of Exponential Growth

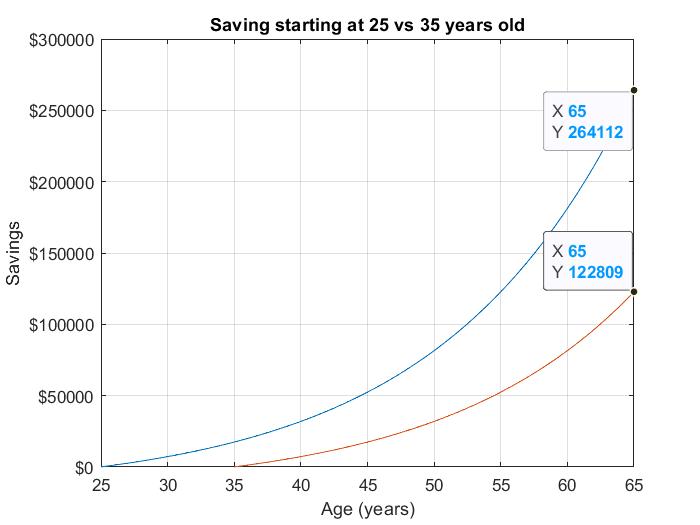

Let me illustrate the significance of time when it comes to your savings account. Assuming a conservative annual growth rate of 7% (the average return of the S&P 500 over the last 30 years, adjusted for inflation) and a monthly savings contribution of $100, the impact is astounding.

If you were to retire at the age of 65, the difference between starting early at age 25 and starting 10 years later is more than double. Even after accounting for the disparity in the total amount saved, with the later start resulting in less money invested, the mathematical comparison is roughly $25,000 / $12,200 > 2!

If you were to retire at the age of 65, the difference between starting early at age 25 and starting 10 years later is more than double. Even after accounting for the disparity in the total amount saved, with the later start resulting in less money invested, the mathematical comparison is roughly $25,000 / $12,200 > 2!

Embracing Nuances: The Value of Experiences and Life Lessons

While the theory of exponential growth is well-known among financially savvy individuals, as the book describes it, people with a high financial IQ, I’ve come to realize that maximizing happiness, at least for me, does not entail penny-pinching and saving every dollar when I’m young. In my perspective, the money required to live an enjoyable and fulfilling life is highest during youth. These experiences hold significant value to me and, I believe, should hold a similar value for you as well.

Seizing Opportunities in Youth

Allow me to provide a few examples to illustrate this point. When you travel to a foreign country, isn’t it more valuable to do so while you’re young? While this may decrease your savings, the experiences and memories gained are immeasurable. Additionally, youth allows for engaging in physically demanding activities such as hiking, canoeing, and mountain biking, taking full advantage of your physical fitness. This is the natural way of things!

The Power of Childhood Lessons

To make this concept more relatable to those with children, consider the time you spend with your family when your kids are young. These shared moments compound over time, becoming invaluable life lessons. Anything children learn in their early years lays the foundation for their future growth and development, whether they consciously acknowledge it or not.

Midlife: A Period of Peaking Costs

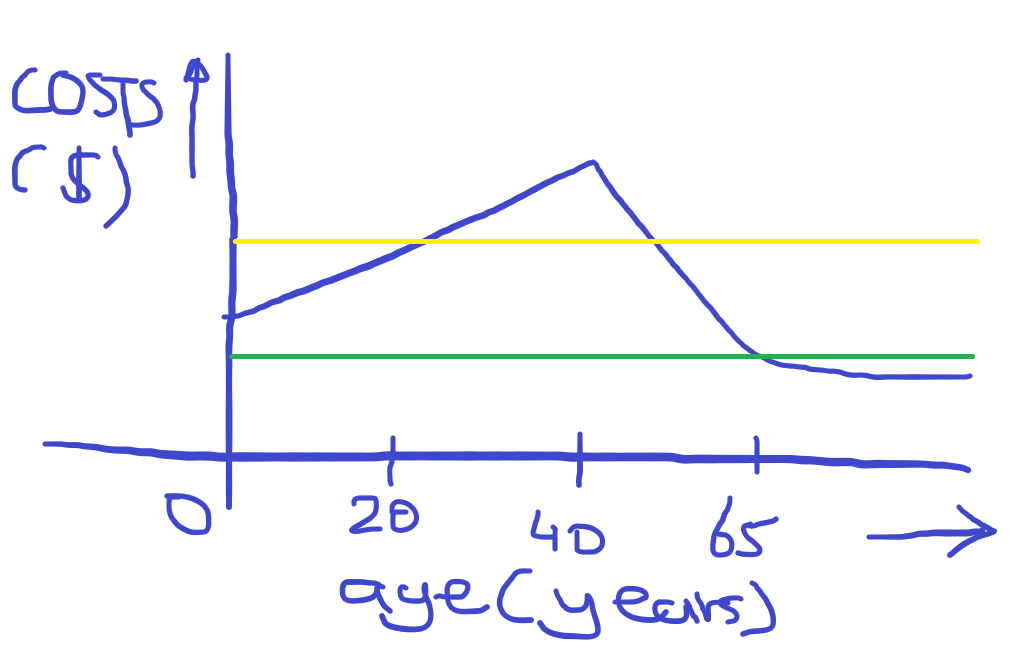

I’ve created a hand-drawn graph to illustrate a typical life trajectory.

As depicted, your costs peak around the age of 40, assuming a conventional lifestyle. During this phase, your children are likely in their teenage years, which can be financially demanding yet rewarding. Alongside providing for your children, you may desire family vacations and perhaps a larger home to accommodate your growing family. However, as your children grow older and become self-sufficient adults, the financial dependence gradually diminishes. By the time you reach retirement age (65), your expenses1 have decreased significantly compared to your physical prime at ages 20-24. While you may not be as physically capable, many individuals choose to embark on new adventures at a more relaxed pace, given the availability of free time and financial resources.

As depicted, your costs peak around the age of 40, assuming a conventional lifestyle. During this phase, your children are likely in their teenage years, which can be financially demanding yet rewarding. Alongside providing for your children, you may desire family vacations and perhaps a larger home to accommodate your growing family. However, as your children grow older and become self-sufficient adults, the financial dependence gradually diminishes. By the time you reach retirement age (65), your expenses1 have decreased significantly compared to your physical prime at ages 20-24. While you may not be as physically capable, many individuals choose to embark on new adventures at a more relaxed pace, given the availability of free time and financial resources.

The Changing Value of Each Dollar as You Age

Considering the information presented above, it becomes evident that the value of each dollar changes throughout life. Instead of solely focusing on costs, you can also perceive it as the value per dollar changing based on your age. I want to emphasize that value is subjective, representing the true worth you assign to something rather than a utilitarian, objective measurement in monetary units ($). This perspective resonates with me at present. There is no magical formula for growing money because when saving money matters most, the value of each dollar is significant, whereas when you have the ability to spend most of your money, the value of each dollar diminishes. In simpler terms, this can be expressed as a higher burn rate when young and a lower burn rate when older. I don’t believe this remains constant throughout life.

Sharing My Perspective on Value with Friends

I’ve shared my contrarian view with friends, and while they couldn’t refute it—acknowledging its personal nature—I hope I’ve influenced their innermost thought patterns, perhaps nudging them slightly closer to my point of view.

Evolving Perspectives

One of the reasons I write this blog is to chronologically organize my thoughts. It’s possible that my view will change when I actually reach the age of 65. I sincerely hope that my perspective proves accurate and serves as a guiding principle for spending money wisely at the right moments, leading to a happy, successful, and fulfilling life. Time will tell.

-

Assuming good health resulting from a balanced lifestyle; in a more pessimistic view, medical expenses could form a substantial portion of costs in later years. ↩

Comments